Signal22 Jun 2015

Banks are using apps to become lifestyle brandsAs the financial sector works to make services increasingly streamlined, mobile money has gained popularity as an easy and secure way to handle cash. Now that apps are more readily accepted, banks are leveraging these platforms to reposition themselves as lifestyle brands.

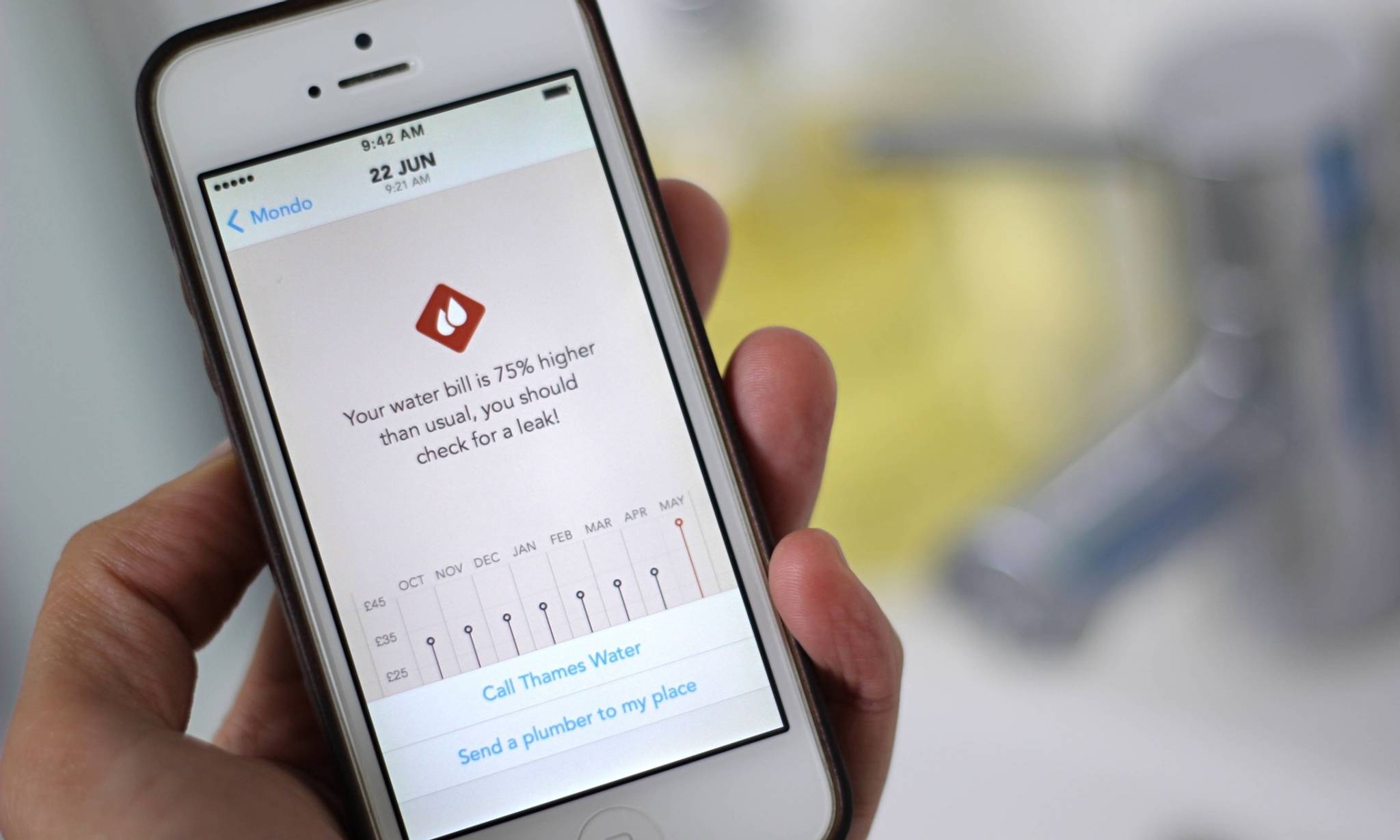

©Mondo Bank (2015)