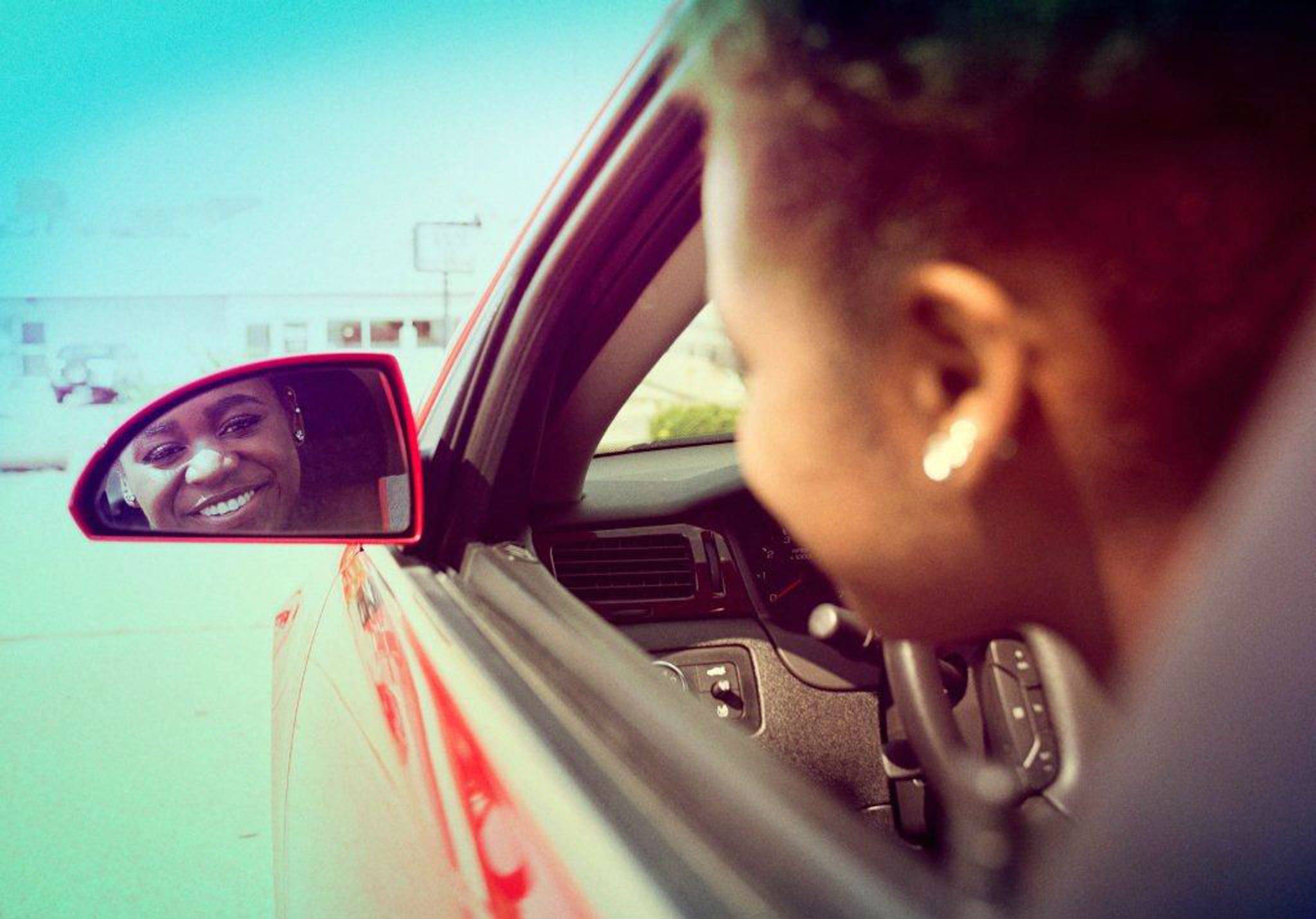

©State Farm, Creative Commons (2014)

Case Study|14 Apr 2015

Progressive: rewarding drivers that play it safeInsurance is a necessary evil; it's a grudge purchase that people would rather not think about. Smart insurers like Progressive are using black box technology to monitor their customers – safe driving can lead to double-digit cost cuts. But are people comfortable trading their data for rewards?

- Sectors

- Locations North AmericaUnited States

Related